When YNAB added targets (back then they were called goals), it was such a great feature addition. But the target types were challenging to understand. In fact, it wasn’t until I took my training to become YNAB Certified Budgeting Coach that I actually understood the target types and could explain them. Even then, the ones that I personally used less often took me a minute to decipher.

Thankfully, that’s all changing. YNAB has just started rolling out new, simplified targets. It’s a revamp of the best kind. My understanding is that new YNAB users and so far about 10 percent of existing users have seen the new target types when they update. Within a month or two everyone will have them.

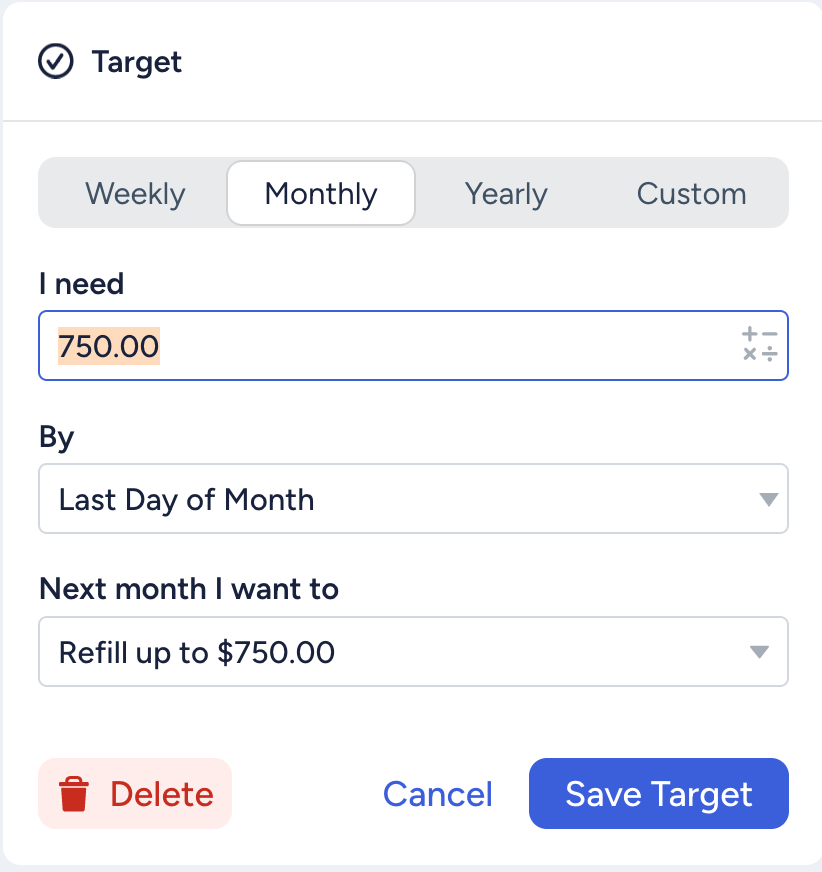

YNAB has distilled the targets down to just a few questions. After you’ve designated an amount, you use the drop down menus to answer two questions:

- When you need the money

- What you want to do next month

In the “Next Month I want to” field, you’re offered the option to refill up to that amount and whatever you don’t spend will get applied toward next month’s amount. (Formerly known as Needed for Spending target.) The other option is to set aside another $xx.xx (whatever your designated amount is) next month, the equivalent of a monthly savings builder.

Here are a few screenshots so you can see what I’m talking about.

My groceries target, which was originally set up as a monthly Needed for Spending target:

My electric bill target, formerly a monthly savings builder target:

My car insurance, which I pay every six months:

And, finally, here’s a screenshot of my new emergency fund target, which I want to increase from $4000 to $6000 by December 2025.

You can dig into the nitty gritty on the revamped targets on this support page on YNAB’s website.

I think this is going to make targets so much easier for everyone. They are such a useful YNAB feature–in fact, I think they’re an integral feature. I’m so excited they will feel more accessible, especially to new users.

Leave a Reply