The YNAB Blog

-

My favorite day of the month

Tomorrow is June 1st. Ever since I got a month ahead in YNAB, the first day of the month has become my favorite. Here’s why. Once I’ve entirely funded a month, I choose to assign additional funds that come in to a category called Future Months. The alternative would be to flip ahead to a…

-

How YNAB is helping me navigate a move

After decades years in our home (our first home!), my husband and I have decided to move. It was a big decision, of course. And it’s a good decision for us. YNAB was instrumental in helping us figure out the financial side of the decision and giving us peace of mind. We’ve to decided to…

-

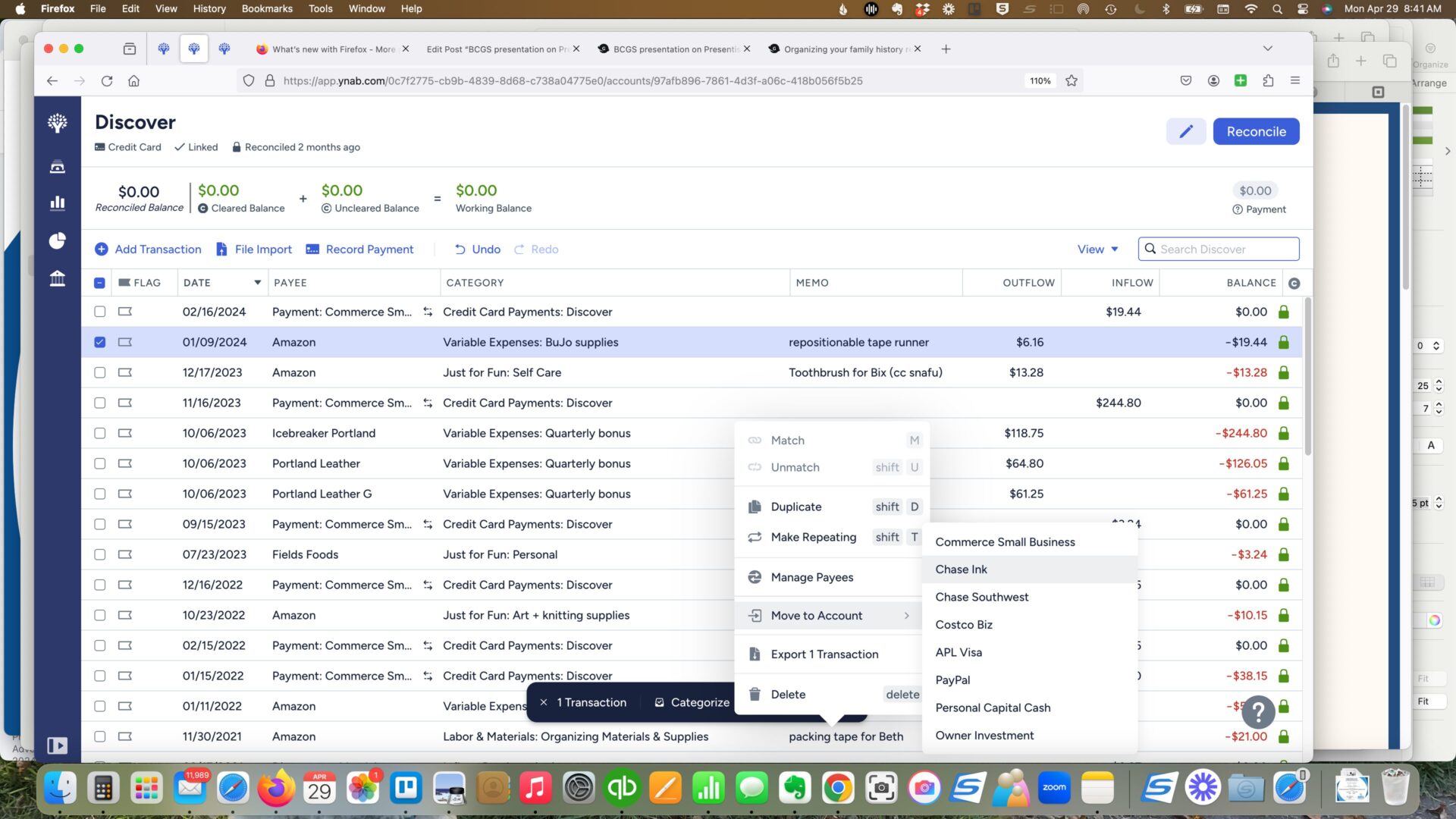

Quick Tip: Move a transaction to another account

Have you ever manually entered a transaction into the wrong account? I typically use Direct Import but occasionally I enter a transaction manually. One reason I prefer Direct Import is to avoid entry errors, which I seem to inevitably make. One of those entry errors is entering a transaction into the wrong account. For example,…

-

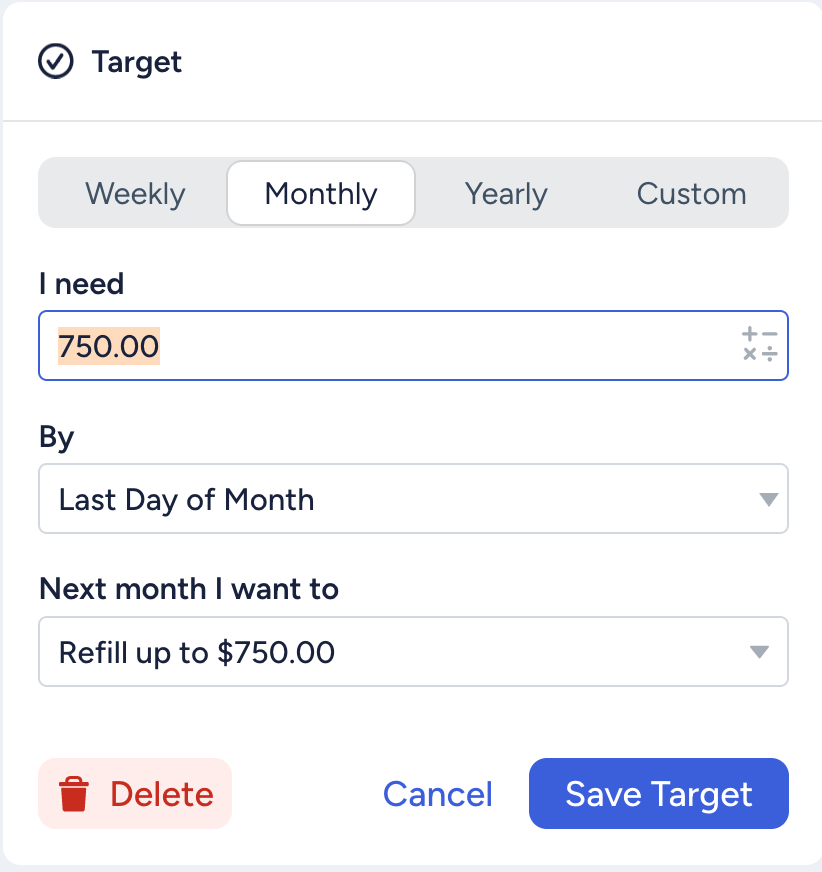

Simplified targets are coming!

When YNAB added targets (back then they were called goals), it was such a great feature addition. But the target types were challenging to understand. In fact, it wasn’t until I took my training to become YNAB Certified Budgeting Coach that I actually understood the target types and could explain them. Even then, the ones…

-

Are you still paying for your kids’ cell phones?

So many of my budget clients have large cell phone bills. When we take a look at the bill, we see that their children’s cell phones are bundled into their bill. More often than not, the practice started when their kids were still dependents. Yet the parents keep on paying. I always push back on…

-

Things to do at the end and beginning of a month

Note: This is a lightly edited version of a post I created last year that offers a good reminder of the importance of paying attention to YNAB at the turn of the month. The turn of the month is a special time in YNAB. When the calendar month rolls over, things happen. Luckily, they’re predictable,…

-

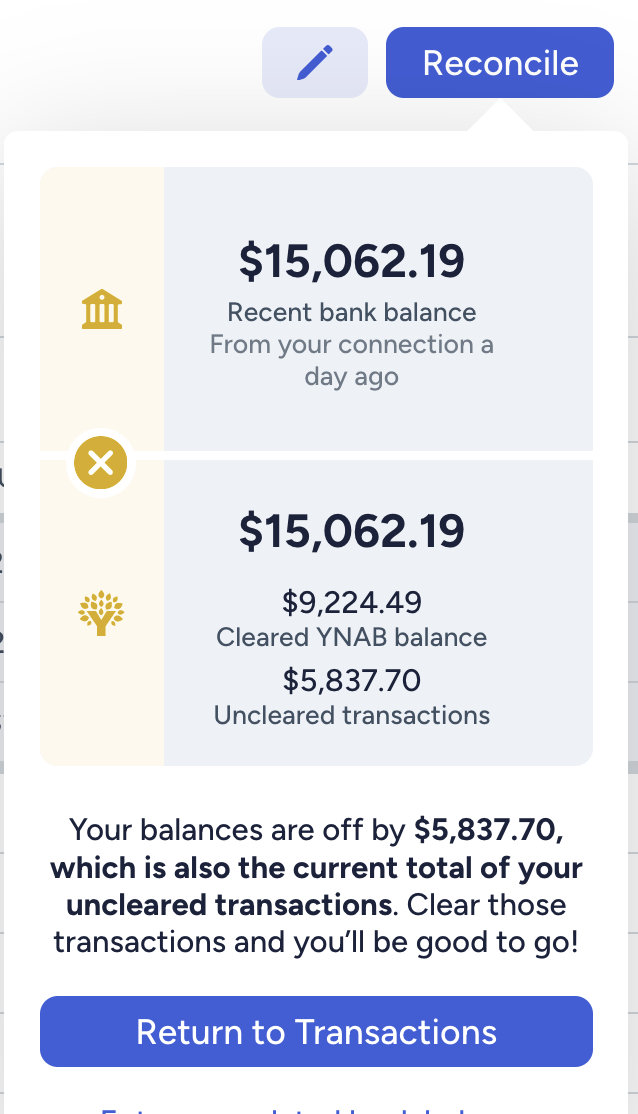

Tips for finding discrepancies

If you’ve tried to reconcile your accounts in YNAB and given up because you couldn’t find the problem, you might had had YNAB do a reconciliation balance adjustment. That’s fine. But if the discrepancy is large (say, $100 or more) I think it’s worth looking a little harder before doing an automatic adjustment. Last week…

-

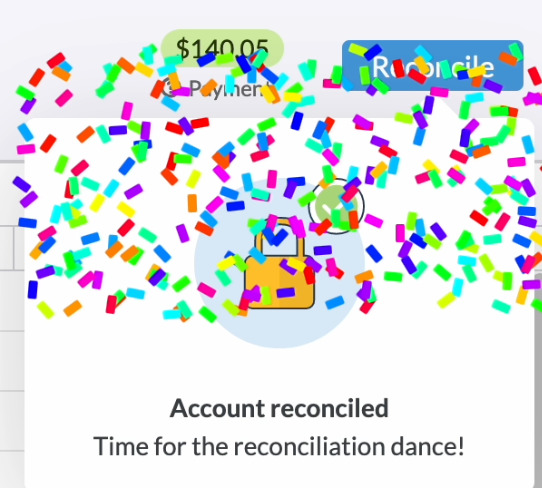

Why it’s important to reconcile (and how to do it)

Once you’re in the YNAB groove, you stop looking at your bank balance and instead consult your budget when you’re deciding whether to spend money on something. Because you’re putting away money for True Expenses, your bank balance swells. But all that money is accounted for. (It’s what’s known as being YNAB Broke.) So you…

-

Do your taxes sooner rather than later

In the United States, most federal and state income taxes are due on April 15. A lot of people put off doing their taxes. According to the 2024 Tax Procrastinators report, 29 percent of Americans procrastinate on their taxes. (I would have guessed that figure was higher!) I’ll never forget the time I had to…

Are there YNAB and budgeting topics you’d like me to write about?