The YNAB Blog

-

Handling a reversed charge in YNAB

I visited a friend in New York over the weekend and at the end sent her $145 via Venmo, reimbursing her for my part of a couple of dinners out. To my surprise, Venmo took the money out of my bank account twice. Before I had a chance to contact my bank, I had a…

-

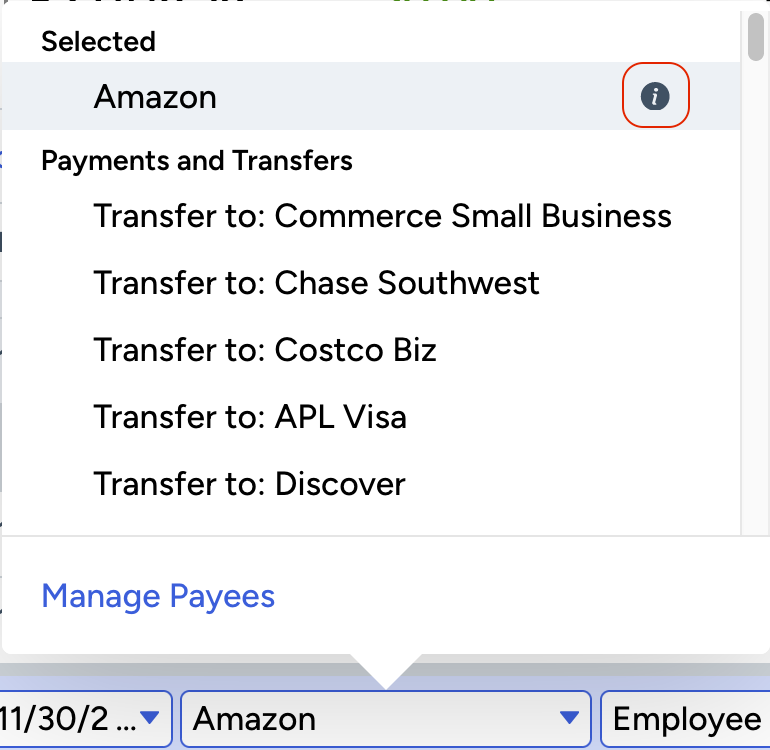

Help with categorizing transactions from major retailers

If you, like me, shop at Amazon or Target or other major retailers that sell a huge variety of items, it can be tedious to categorize the transactions. I think it’s worthwhile to do so, so that your budget contains an accurate record of your spending. YNAB has made it a little bit easier by…

-

Covering overspending at the end of the month (video)

The turn of the month is so important in YNAB that I blog about it pretty much every month. Today, I made a video to show you what happens if you don’t cover overspending and how to go about covering it. If you move to a new month with red or yellow bubbles in your…

-

Ten reasons I’m grateful for YNAB

It’s the season to express gratitude and I am so very grateful for YNAB. Here are ten of the reasons I’m thankful in my own financial life for this amazing budgeting methodology and software.

-

New Snooze a Target feature

As a coach, I get to see new features as soon as they’ve started rolling out, so it’s possible that you haven’t seen this in your own budget yet. But a new feature I’m excited about that showed up in my budget yesterday is Snooze a Target. You can now elect to disable a target…

-

Some places to trim the budget

When I work with clients to set up a new budget, we start with their budget template, deciding on the categories and category groups for their new budget. Then we add targets (sometimes we add categories and targets at the same time). The last step is to link their accounts and assign the money they…

-

My daily YNAB routine

I think that a key to being a successful YNABer is to set up a routine for interacting with YNAB on a regular basis. If you let transactions build up, they can easily become overwhelming. And the longer you wait to categorize a transaction the harder it is to remember what you spent money on.…

-

Do you have a holiday gifts category?

It’s the end of October and the December gift-giving season is just around the corner. Let’s face it: giving gifts is a lot more enjoyable when you feel you can afford them. If you don’t already have a Gifts category in your budget, I encourage you to create one. Then set a Monthly Savings Builder…

-

How to deal with an inheritance in YNAB

One of the worries people have when they get a windfall is that they are going to blow it with nothing to show for it. I know I felt that way last year when my father passed away and left my brothers and me some money. Thankfully, I was well versed in YNAB so I…

Are there YNAB and budgeting topics you’d like me to write about?