Category: Best Practices

-

How many accounts should you have?

As a professional organizer, I’m sometimes asked how many of a certain thing a person should have. My standard response is, “As many as you need and no more.” The same holds true for the number of bank accounts and credit cards you should have. The more you have, the more complicated YNAB becomes. Many…

-

Pay close attention at the turn of the month

You’re a smart YNABer if you pay close attention to your budget on the last day of the month and the first days of a new month. In fact, it’s so important that I’m offering a drop-in “Close Out the YNAB Month” Zoom party for clients on the last day of the month. The first…

-

Handling annual subscriptions in YNAB

One of the miracles of YNAB is Rule Two: Embrace Your True Expenses. Annual subscriptions are great examples of true expenses. When you’re following Rule Two, you put away one-twelfth of the annual expense every month. When the bill comes due, the money is waiting. In my life, these bills are often autopaid and easily…

-

The dreaded red Ready to Assign

It is startling to open your budget and see a negative Ready to Assign (RTA) at the top of the screen. Instead of the soothing grey or the buoyant green RTA you probably expect, the red one is like an ugly alarm. And this is the time of the month that it usually happens, because…

-

Keep an eye on your direct import

Linking your bank and credit card accounts to YNAB can make it very easy to keep up with your transactions. They’re entered for you; all you have to do is categorize, recategorize or approve each transaction. But sometimes the direct import link breaks. And when it does, you need to pay attention. Recently I’ve had…

-

Time to check your targets?

I’ve had a tumultuous summer, with downsizing from a house to an apartment and a major surgical procedure in my family. But YNAB has kept me on the straight and narrow financially. For the most part, I kept up with daily transaction categorizing, covering overspending and reconciling. (Daily is so much easier than letting it…

-

How I process a deposit with YNAB + Profit First

I love the Profit First methodology to help small businesses be more profitable. I first read the book Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine, by Michael Michaelowicz in 2015 and shortly thereafter started using it for my organizing. It revolutionized how I think about my business’s money. When…

-

My favorite day of the month

Tomorrow is June 1st. Ever since I got a month ahead in YNAB, the first day of the month has become my favorite. Here’s why. Once I’ve entirely funded a month, I choose to assign additional funds that come in to a category called Future Months. The alternative would be to flip ahead to a…

-

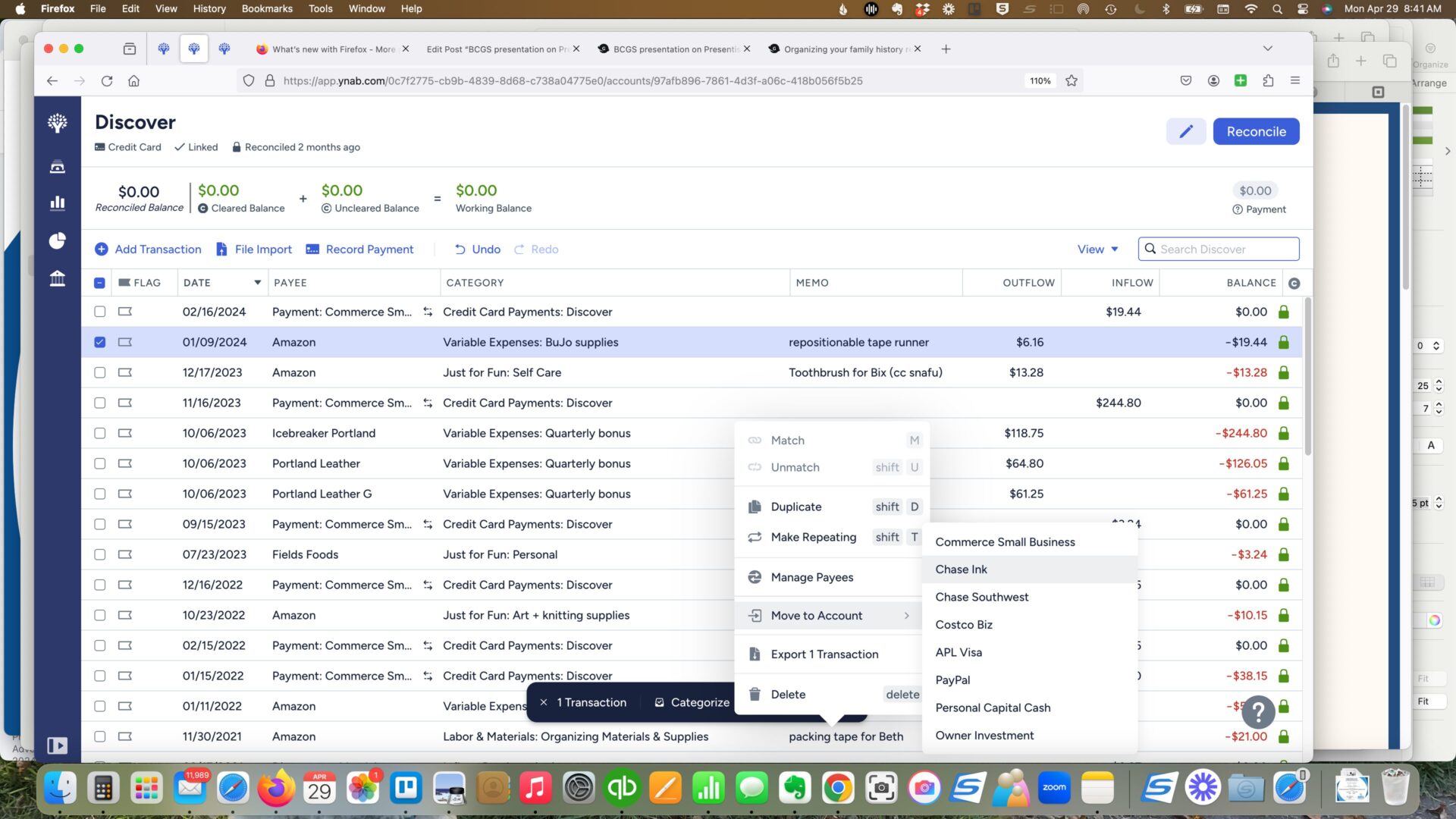

Quick Tip: Move a transaction to another account

Have you ever manually entered a transaction into the wrong account? I typically use Direct Import but occasionally I enter a transaction manually. One reason I prefer Direct Import is to avoid entry errors, which I seem to inevitably make. One of those entry errors is entering a transaction into the wrong account. For example,…