Category: Best Practices

-

Things to do at the end and beginning of a month

Note: This is a lightly edited version of a post I created last year that offers a good reminder of the importance of paying attention to YNAB at the turn of the month. The turn of the month is a special time in YNAB. When the calendar month rolls over, things happen. Luckily, they’re predictable,…

-

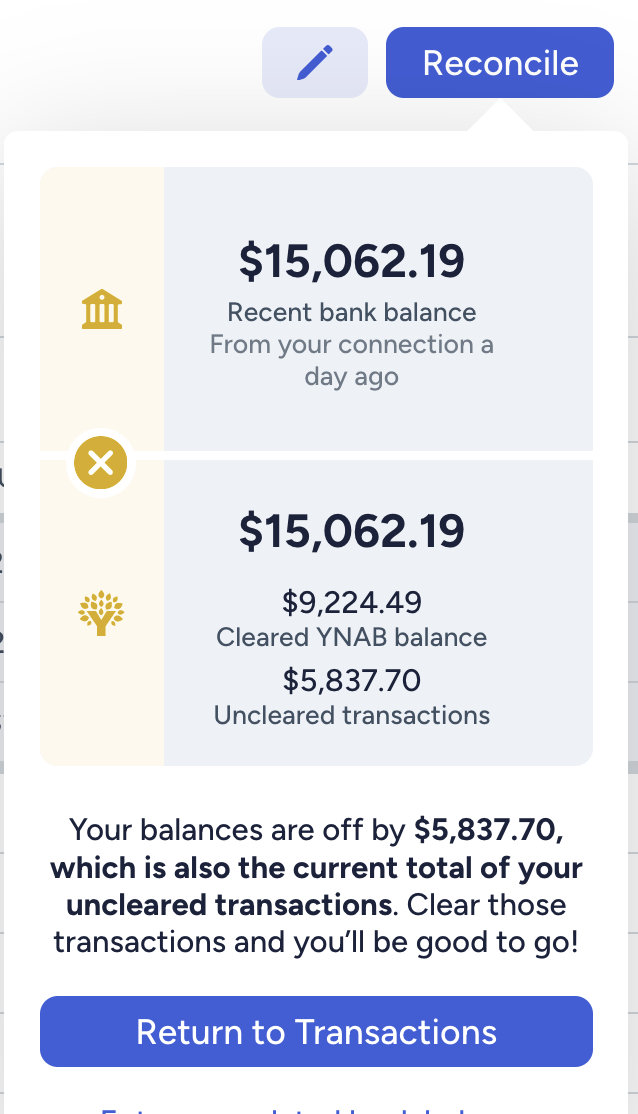

Why it’s important to reconcile (and how to do it)

Once you’re in the YNAB groove, you stop looking at your bank balance and instead consult your budget when you’re deciding whether to spend money on something. Because you’re putting away money for True Expenses, your bank balance swells. But all that money is accounted for. (It’s what’s known as being YNAB Broke.) So you…

-

Do your taxes sooner rather than later

In the United States, most federal and state income taxes are due on April 15. A lot of people put off doing their taxes. According to the 2024 Tax Procrastinators report, 29 percent of Americans procrastinate on their taxes. (I would have guessed that figure was higher!) I’ll never forget the time I had to…

-

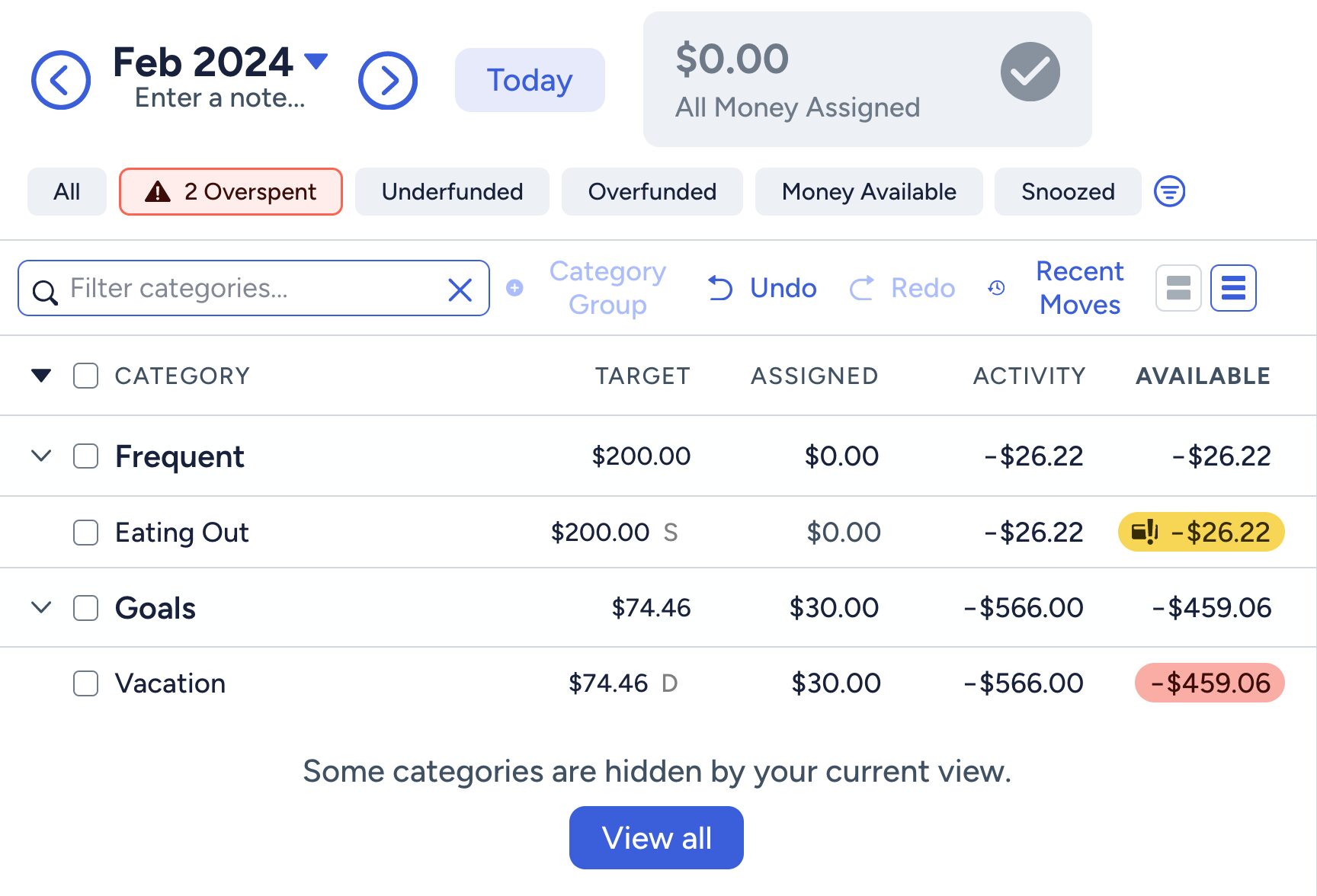

Quick Tip: Check your February transactions!

Today is March 1, which is a fun day for me because I get to do some budgeting! I was reminded today of the importance of making sure I process all my February transactions before assigning money in March. This morning, I categorized all my pending transactions and clicked Enter Now so that they would…

-

Have you checked your credit report lately?

Nowadays, it seems very easy to get ahold of your credit score (your FICO score). I know that I can easily access mine through several of my credit cards. Back in the day, you had to pay to get your score, so this is great. But there’s more to the credit report than your credit…

-

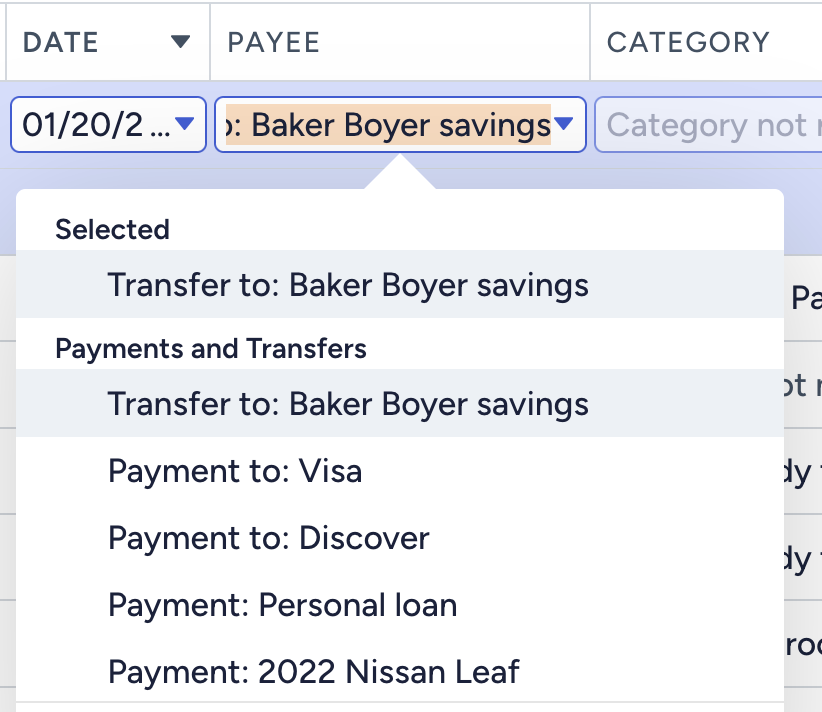

Entering transfers in YNAB

It can be a little confusing when you transfer money from one account to another in YNAB. The difficulty comes in when you’ve imported a transaction that has the Payee already entered and it asks for a category. But the thing to remember about transfers is that they don’t require a category. When you click…

-

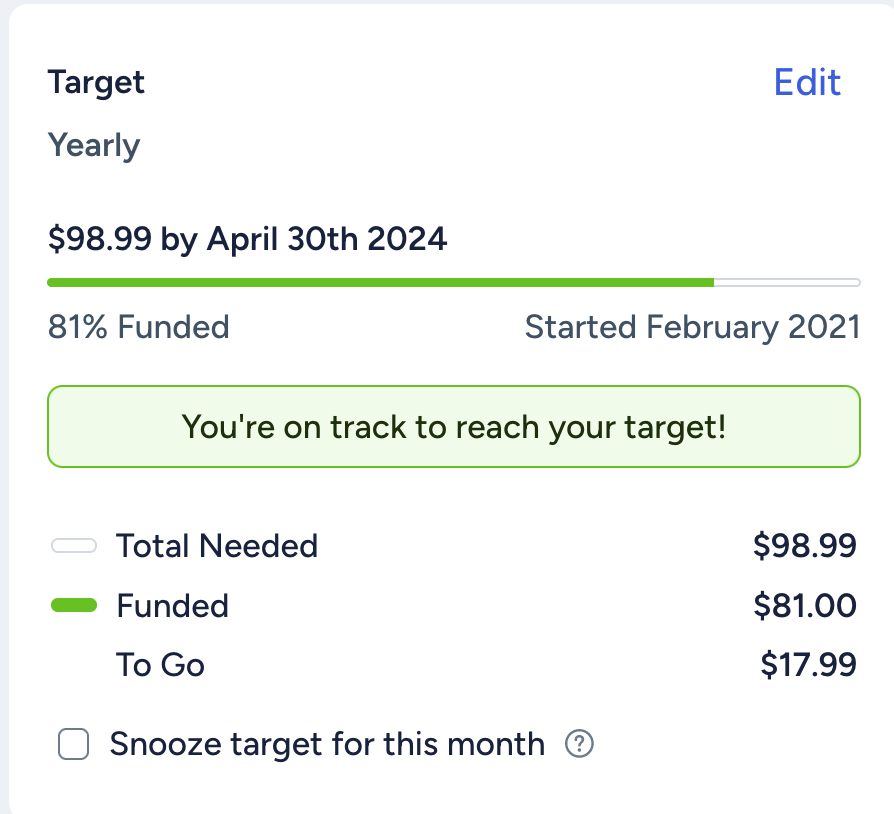

Are you budgeting for YNAB?

If it’s your first year of YNAB, you might not have added a category for your YNAB subscription (particularly if you’re in your trial period!). It’s more economical to pay for an annual subscription, which is $99 (which amounts to $8.25 a month), than it is to pay monthly at $14.99 a month. And if…

-

Handling credit card rewards in YNAB

One of the great things about YNAB is that it allows you to use your credit card like a debit card. If the things you buy with your credit card are covered in the budget, YNAB moves the amount of the transaction from the budget category to the credit-card payment category while it waits for…

-

Year-end budget scan

There are just ten days left in 2023 and this morning I took the opportunity to take a look at my budget to see if I think there’s anything I need to adjust. I’m toying with doing a Fresh Start in 2024 but I’m pretty much in the “If it ain’t broke don’t fix it”…